Builder Buyer Agreements: Key Points Every Buyer Should Understand

Buying your dream home is one of the most important milestones in life. For most Indians, it’s not just a financial investment but also an emotional journey. However, while the excitement of purchasing a flat or property is high, the reality is that a poorly understood builder buyer agreement can easily turn that dream into a nightmare. Hidden clauses, confusing legal jargon, and one-sided terms often tilt the balance in favor of the builder, leaving the buyer vulnerable.

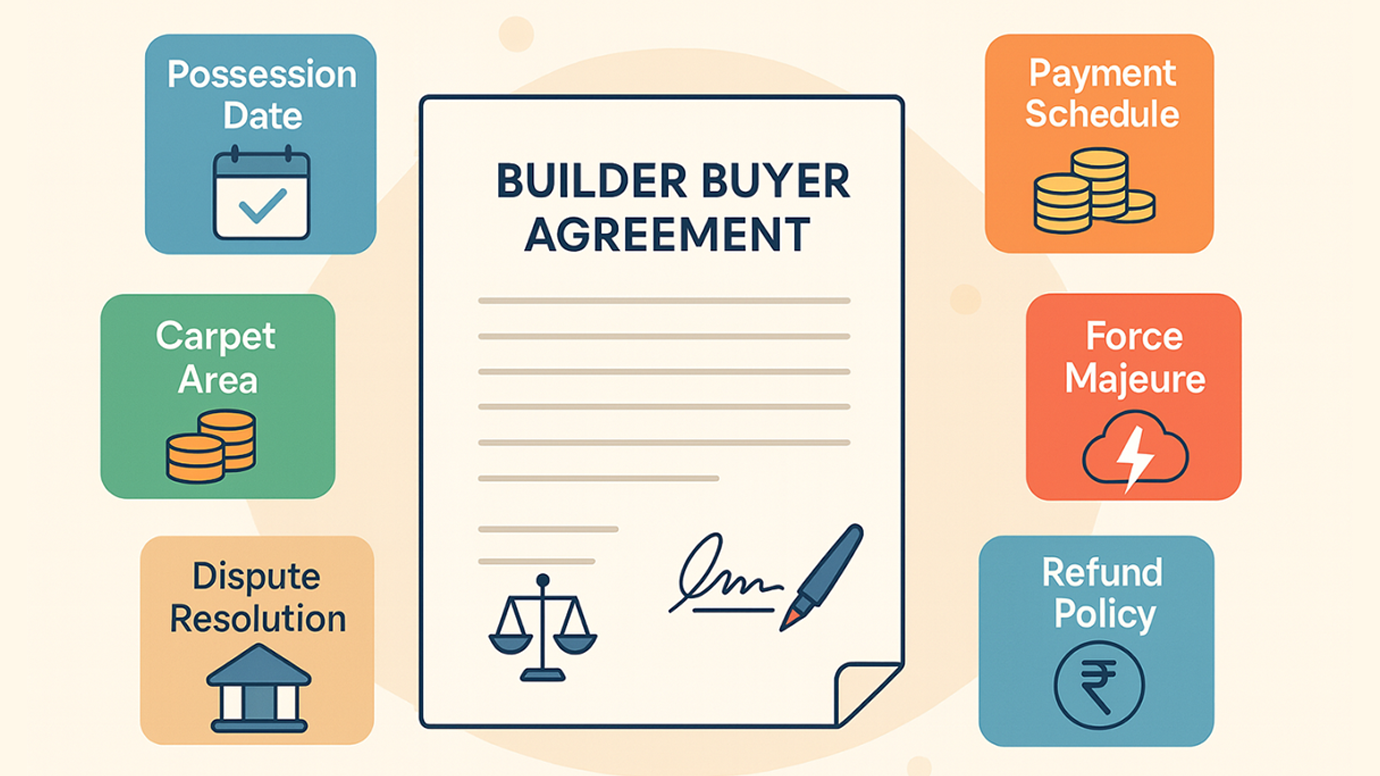

A builder buyer agreement is essentially a legally binding contract that lays down the terms and conditions between the builder and the homebuyer. Think of it as a specialized form of a property sale agreement that governs not just the transfer of property, but also timelines, construction quality, payment milestones, penalties, and buyer rights. Unlike a simple seller agreement or buyer and seller contract, this agreement goes deeper — it dictates nearly every stage of your relationship with the builder, right from booking to final possession.

The challenge is that many buyers treat the agreement of purchase and sale as just another formality and sign it without fully understanding its implications. Builders, on the other hand, often insert clauses that protect their own interests, such as vague possession timelines, heavy penalties on delayed buyer payments, and limited accountability for construction delays.

That is why it is crucial to carefully review every seller and buyer agreement before signing. Consulting a legal professional ensures that the property sale agreement is balanced, compliant with RERA, and truly protects the buyer’s rights. In short, your builder buyer agreement is more than paperwork — it is your shield against future disputes, delays, and financial loss.

What is a Builder Buyer Agreement?

In the simplest terms, a builder buyer agreement is the contract that governs the relationship between a property developer (the builder) and the homebuyer. It is not just a piece of paper you sign at the time of booking — it is the document that decides your rights, responsibilities, and legal protection throughout the home-buying journey.

Think of it as a specialized property sale contract. While a standard seller and buyer agreement focuses only on transferring ownership of property, a builder buyer agreement goes much deeper. It spells out key details such as:

- The construction timeline and date of possession

- The payment schedule linked with milestones

- What happens if either party defaults

- The penalties for delay — both from the builder’s side and the buyer’s side

- Specifications regarding carpet area, amenities, and project approvals

Because of this comprehensive scope, the agreement acts as a legal framework that binds both parties. It is recognized as a real estate sales agreement, enforceable in Indian courts, and is protected under the provisions of RERA (Real Estate Regulatory Authority Act, 2016).

From a legal perspective, signing a buyer and seller contract of this nature is no small step. Once executed, the agreement of purchase and sale is legally binding, which means both the builder and the buyer must fulfill their obligations as per the written terms. Any breach can lead to litigation, monetary penalties, or even cancellation of the deal.

In short, a builder buyer agreement is not just paperwork; it is the foundation of trust between the two parties. By setting the terms clearly, it ensures that the buyer knows exactly what to expect, and the builder is held accountable for delivering the promised property within the agreed timelines.

Key Clauses of Builder Buyer Agreement that Every Buyer Must Check

When you sign a builder buyer agreement, you’re entering into a legally binding arrangement that will affect every aspect of your property purchase. Unfortunately, many homebuyers in India skim through the fine print of an agreement for flat sale, property sale agreement, or even a simple seller and buyer agreement, without realizing the long-term consequences. Here are the most critical clauses you must carefully review before signing any agreement of property sale or buyer and seller contract.

1. Possession Date & Delay Penalties

One of the biggest disputes in Indian real estate arises from delayed possession. Your agreement to sell property should clearly state the exact date of possession or a fixed timeline from the date of execution.

- As per RERA, if the builder delays, you are entitled to compensation or even a refund.

- Watch out for vague phrases like “possession will be given within 36 months from approvals,” which are common tricks in agreements of purchase and sale.

- Ensure the penalty for delay is fair and not disproportionately harsh only on the buyer.

2. Payment Schedule

Most builders link payments to construction milestones, but many agreements insert one-sided terms.

- In a balanced property sale agreement, payments should be staggered in sync with the actual progress of construction.

- Avoid “front-loaded” payments where you pay a large chunk before significant progress is made. This creates unnecessary risk if the project gets stalled.

3. Carpet Area vs. Super Built-Up Area

One of the most misunderstood concepts in an agreement for flat sale is the difference between carpet area and super built-up area.

- Carpet area: the actual usable space inside your home.

- Super built-up area: includes lobbies, staircases, and even clubhouses.

- RERA mandates that the sale should be based only on carpet area. Always ensure your agreement of property sale follows this rule.

4. Force Majeure Clauses

Many builders misuse this clause in a builder buyer agreement.

- It allows them to delay possession citing unforeseen events.

- While genuine events like natural disasters or government bans are valid, routine delays in approvals or funding shortages are not.

- Ensure the agreement of purchase and sale does not give builders unlimited protection under this clause.

5. Cancellation & Refund Policy

Your seller and buyer agreement must clearly define refund terms.

- If the buyer cancels, what portion is forfeited?

- If the builder defaults, how soon will the refund be processed?

- Under RERA, builders are required to refund within 45 days if the project is not delivered.

This clause protects you from financial loss in case things don’t go as planned.

6. Interest Rates for Delayed Payments

Builders usually impose heavy interest rates on buyers for late payments. But what happens if the builder delays?

- A fair buyer and seller contract should impose equal penalties on the builder for delays.

- Compare the terms carefully in your agreement to sell property — it should be balanced for both sides.

7. Dispute Resolution & Jurisdiction

Every property sale agreement will mention how disputes will be resolved.

- Be cautious if the seller agreement restricts your right to approach consumer courts or RERA.

- Buyers in India can approach RERA, consumer forums, civil courts, or even arbitration depending on the dispute.

- Ensure your agreement for flat sale does not unfairly restrict your rights.

Reviewing these clauses before signing any agreement of purchase and sale can save you years of litigation and financial strain. Always consult a property lawyer who can scrutinize the fine print of your seller and buyer agreement and ensure the terms are buyer-friendly.

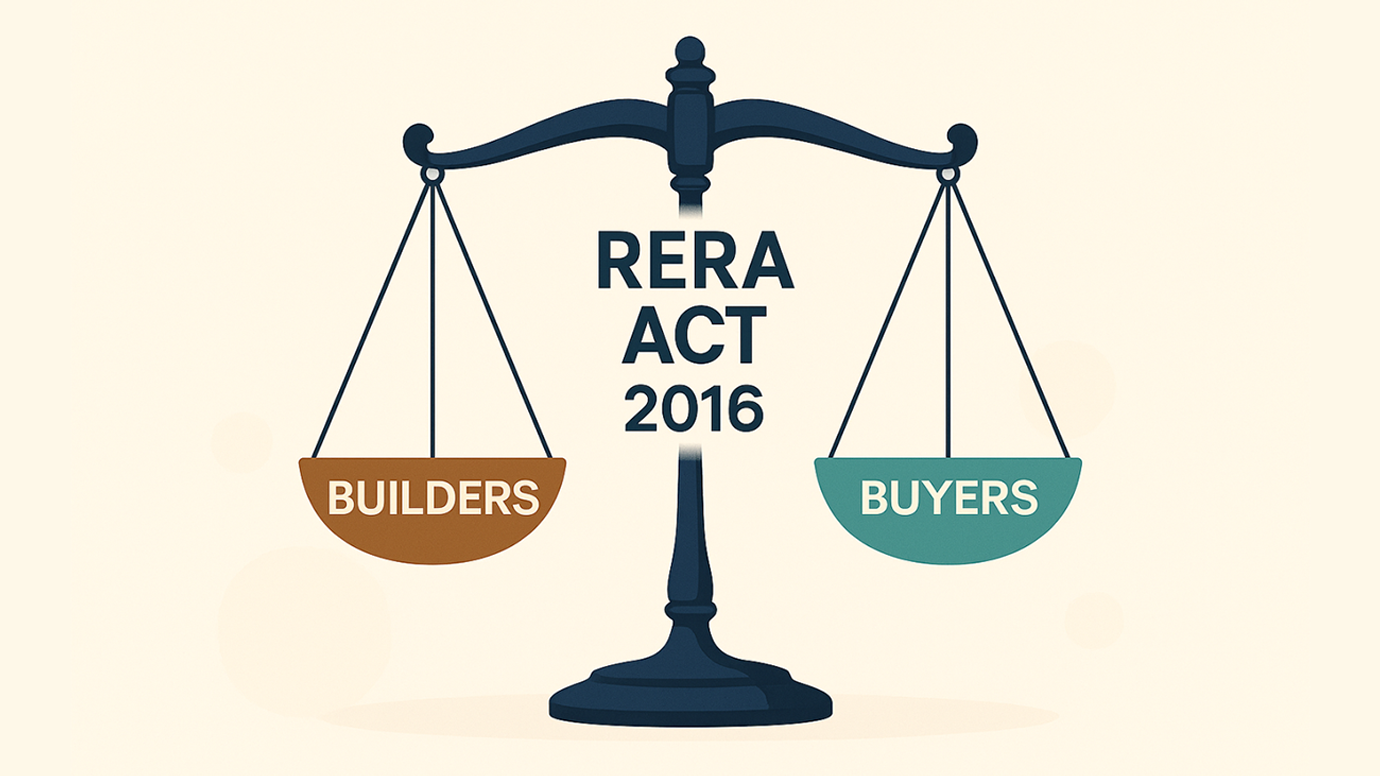

Role of RERA in Protecting Buyers

For decades, homebuyers in India struggled with delayed projects, unfair clauses in a builder buyer agreement, and lack of accountability from developers. To bring transparency and protect consumer rights, the government introduced the Real Estate (Regulation and Development) Act, 2016 (RERA) — a landmark reform that reshaped the property market in favor of the buyer.

1. Brief Overview of RERA Act, 2016

RERA was enacted to regulate the real estate sector and ensure fairness in transactions. Before its implementation, buyers often signed a seller and buyer agreement or property sale contract without clear timelines or remedies for builder defaults. Now, RERA requires builders to follow a standard format, making every real estate sales agreement or agreement for sale of immovable property more transparent and enforceable.

The Act applies to both residential and commercial projects and establishes state-level Real Estate Regulatory Authorities that buyers can approach for grievances.

2. Mandatory Registration of Projects

Under RERA, every real estate project above a certain size must be registered with the respective state’s RERA authority before being marketed or sold.

- Builders must provide complete project details, including approvals, timelines, and financial disclosures.

- This ensures that buyers entering into a builder buyer agreement or seller agreement are dealing with a legally registered project rather than a fraudulent or unauthorized development.

- Registration also means that if there are disputes, the buyer can hold the builder accountable under the law.

3. Buyer’s Remedies Under RERA

The greatest strength of RERA lies in the rights it gives to buyers who enter into an agreement for sale of immovable property or any property sale contract. Key remedies include:

Compensation for Delayed Possession:

If the builder misses the possession date promised in the seller and buyer agreement, the buyer can claim interest for every month of delay.

Right to Refund:

Buyers can demand a full refund with interest if the builder fails to deliver as per the real estate sales agreement.

Quality Assurance:

If defects appear within five years of possession, the builder must rectify them at no extra cost.

Transparency in Carpet Area:

RERA mandates that properties can only be sold based on carpet area, preventing manipulation in the builder buyer agreement.

Quick Resolution of Disputes:

RERA authorities must resolve complaints within 60 days, making it faster than traditional courts.

For Indian homebuyers, RERA acts as a safety net against unfair practices hidden in a seller agreement or buyer and seller agreement. By making property sale contracts transparent and enforceable, it restores confidence in the real estate sector and ensures that every builder buyer agreement is backed by law, not just trust.

You can also read: How to complaint in RERA

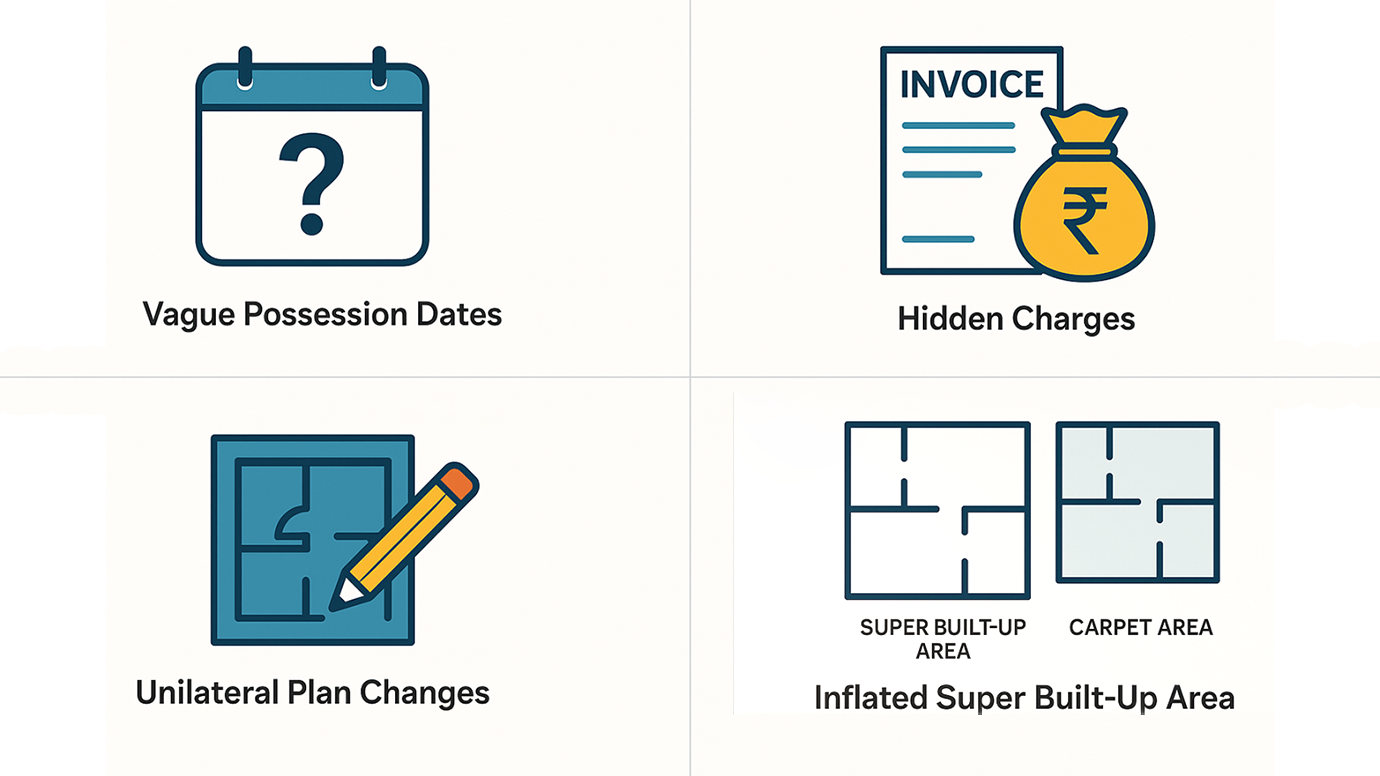

Common Tricks Builders Use

While buying a property is a dream for most Indians, it’s also a phase where excitement often overshadows caution. Builders, knowing this, sometimes insert hidden terms in a builder buyer agreement that favor them instead of the buyer. Many people sign a seller and buyer agreement without reading the fine print, only to realize later that they’ve accepted unfair terms. Here are some of the most common tricks you should be aware of:

1. Vague Possession Dates

One of the oldest tricks is inserting unclear possession timelines. Instead of stating a fixed date, agreements often say “possession will be handed over within 36 months from the date of approvals.” This loophole allows builders to keep extending the deadline indefinitely. A fair buyer and seller contract must have a clearly defined possession date along with penalties if the builder delays.

2. Hidden Charges

Attractive prices often hide additional costs. Builders sometimes add charges for clubhouse facilities, car parking, power backup, and even hefty maintenance deposits. These costs may not be highlighted at the time of booking but appear in the final agreement for house purchase. Buyers must ensure that every expense is clearly mentioned in the agreement of purchase and sale to avoid last-minute shocks.

3. Unilateral Rights to Change Project Plan

Some seller and buyer agreements give the builder sweeping powers to alter the building plan, increase the number of units, or change specifications without the buyer’s consent. Such clauses leave buyers powerless. A transparent agreement for flat sale should protect the buyer’s rights and prevent unilateral modifications unless approved by the majority of allottees.

4. Inflated Super Built-Up Area

Another common trick is selling property based on “super built-up area,” which includes common spaces like lobbies, lifts, and clubhouses. Buyers end up paying more while receiving a much smaller actual carpet area. Under RERA, sales must be based only on carpet area. Make sure your agreement of purchase and sale clearly defines carpet area, not inflated super built-up numbers.

Builders often rely on buyers’ lack of attention to detail while drafting an agreement for flat sale or an agreement for house purchase. By carefully reviewing every clause in the buyer and seller contract, you can safeguard yourself against hidden charges, delays, and unfair practices. Remember — once you sign a builder buyer agreement, it becomes legally binding, so awareness and vigilance are your strongest shields.

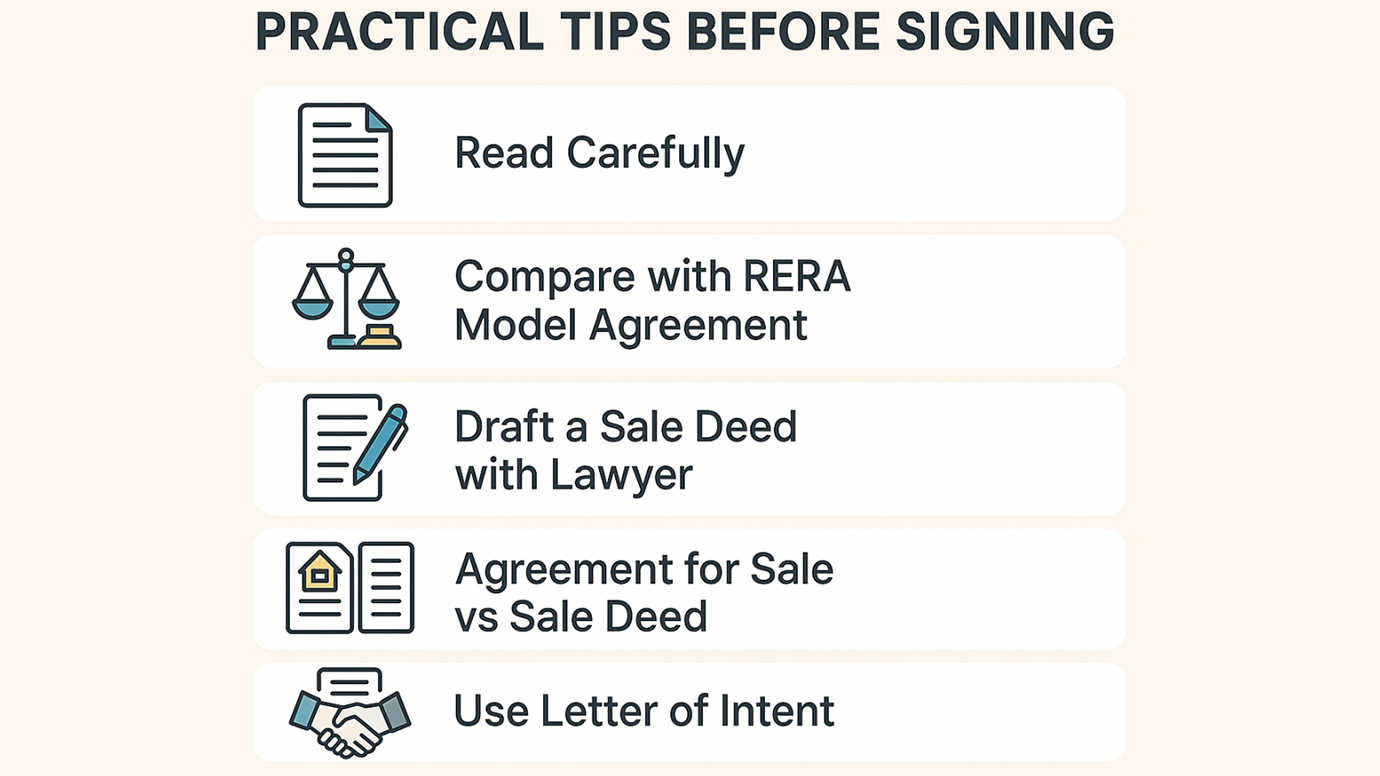

Practical Tips for Buyers Before Signing

For most Indians, buying a home is the biggest financial commitment of their lives. But in the rush to book a dream flat, many buyers overlook the fine print of the builder buyer agreement or sign an agreement of purchase and sale without proper scrutiny. This is exactly where mistakes happen. To protect yourself from hidden risks and legal complications, here are some practical tips every buyer should follow before putting pen to paper.

1. Always Read Carefully — Don’t Rely Only on Brochures

Builders often advertise glossy brochures and sample flats, but these are not legally binding. What counts is the builder buyer agreement and related documents. Go through every clause carefully instead of relying solely on marketing material.

2. Compare with RERA Model Agreement

RERA has introduced a model agreement to standardize practices. Compare your agreement of purchase and sale with this template to ensure that your rights are protected. Any major deviation in timelines, penalties, or specifications should be treated as a red flag.

3. Always Draft a Sale Deed with Professional Help

A crucial step is to draft a sale deed properly. Many buyers assume the builder’s draft is standard, but hidden clauses can create problems later. A well-prepared sale deed agreement clearly establishes ownership, possession rights, and obligations of both parties. Getting it reviewed or drafted by a property lawyer ensures your interests are safeguarded.

4. Understand the Difference Between Agreement for Sale and Sale Deed

Many buyers confuse these two, but they are not the same.

- An agreement for sale and sale deed are separate stages: the agreement for sale shows your intent and terms, while the sale deed finalizes the transfer of ownership.

- Without a properly registered sale deed, ownership does not legally pass to the buyer. This is why reviewing both documents carefully is non-negotiable.

5. Use a Letter of Intent Before Finalizing

Before signing the full-fledged agreement, insist on a letter of intent to buy property. This document outlines basic terms like price, size, and possession timeline, creating a record of the builder’s commitments. It also gives you a chance to negotiate and clarify key points before you enter into a binding contract.

Homebuyers should never treat the builder buyer agreement or related contracts as mere formalities. By carefully reviewing the agreement of purchase and sale, consulting a lawyer to draft a sale deed, and understanding the nuances of an agreement for sale and sale deed, you can avoid disputes later. Even a simple letter of intent to buy property can go a long way in ensuring transparency and accountability.

How a Lawyer Can Help You

Buying property in India isn’t just a financial decision — it’s also a legal one. While brochures and builder promises may look attractive, the real protection lies in the paperwork. This is where a property lawyer becomes indispensable. Whether it’s a builder buyer agreement, an agreement of purchase and sale, or a sale deed for land, having a legal expert by your side ensures that your rights are not compromised.

1. Verifying Project Approvals and Drafting Strong Agreements

Builders often lure buyers with quick bookings, but many projects lack proper approvals. A lawyer can cross-check all government clearances, title deeds, and RERA registration before you sign the builder buyer agreement. They can also draft or review the agreement of purchase and sale to make sure it includes fair timelines, penalties for delays, and proper definitions of carpet area.

2. Assistance with Sale Deeds and Land Transactions

Property transactions involving land require extra caution. A well-drafted sale deed for land is the ultimate proof of ownership, and even a small error can cause disputes later. A lawyer ensures that every land sale agreement or land purchase agreement is watertight, covering aspects like boundaries, encumbrances, and registration compliance. This avoids future litigation over ownership or possession.

3. Helping with Land Buying Agreements

If you’re purchasing agricultural or residential plots, a lawyer can prepare a clear land buying agreement or an agreement for buying land that safeguards your investment. These agreements typically include clauses on payment schedules, land use restrictions, mutation of records, and government permissions — details most buyers overlook.

4. Legal Remedies in Case of Builder Disputes

If a builder fails to deliver as promised in the builder buyer agreement, a lawyer can help you take action through RERA, consumer forums, or even civil courts. Whether it’s delayed possession, inflated charges, or breach of the agreement of purchase and sale, legal professionals know the remedies and the fastest way to secure relief.

In India, property documents like the land sale agreement, land purchase agreement, and sale deed for land carry lifelong implications. Consulting a lawyer before signing ensures that every clause in your builder buyer agreement is transparent and enforceable. More importantly, it gives you peace of mind, knowing your hard-earned money is protected by strong legal safeguards.

FAQs

A. A seller agreement is a document that outlines the terms under which a seller agrees to transfer property to a buyer. It establishes initial commitments but does not transfer ownership until the final registered deed is executed.

A. A sale deed agreement is the final proof of ownership once the property is transferred. Without a properly registered sale deed, the buyer cannot legally claim rights over the property.

A. An agreement for sale and sale deed differ in purpose: the agreement for sale records the terms of the transaction, while the sale deed finalizes and legally transfers ownership to the buyer.

A. Having a lawyer draft a sale deed ensures that ownership rights, property boundaries, and obligations of both parties are clearly defined and legally enforceable.

A. A builder buyer agreement is a contract between the builder and the buyer that governs timelines, payment terms, construction quality, and remedies in case of delays or disputes.

A. An agreement of property sale shows the buyer’s intent to purchase under agreed terms, while registration of the sale deed legally transfers ownership.

A. A property sale agreement binds both parties to agreed terms such as possession date, carpet area, and payment schedule, making it crucial to review thoroughly before signing.

A. A letter of intent to buy property sets out preliminary terms like price and timeline before signing a binding contract, helping avoid misunderstandings later.

Conclusion

Buying a home is not just a financial milestone — it is a life dream for most Indian families. But dreams can quickly turn into disputes if the legal paperwork is not carefully understood. At the heart of every property purchase lies the builder buyer agreement, and this single document can decide whether your investment remains secure or lands you in years of litigation.

A well-drafted agreement to sell property or an agreement for house purchase should clearly define timelines, possession dates, penalties, and the rights of both buyer and builder. Unfortunately, many buyers either skim through the fine print or rely blindly on the builder’s version of the contract. This is risky because even a small oversight in a real estate sales agreement can cost you lakhs of rupees, unnecessary stress, and long legal battles.

The safest way forward is to have your builder buyer agreement or related contracts reviewed by a professional property lawyer. A legal expert ensures that the agreement to sell property is compliant with RERA, fair to both parties, and completely transparent. This proactive step not only protects your hard-earned money but also guarantees peace of mind, knowing that your rights as a buyer are fully safeguarded.

Never rush into signing an agreement for house purchase just because the property looks attractive or the builder offers tempting discounts. Always insist on a thorough legal review of the real estate sales agreement. Remember, it is far better to spend a little time and effort upfront than to fight prolonged disputes later.

For more information about related legal topics or to understand how professional legal support works, you can also go to our Homepage for general information.

Disclaimer:

This blog is intended for educational and informational purposes only. It should not be taken as legal advice or relied upon as such. Cases of Builder Buyer Agreements are sensitive and often vary based on individual circumstances, which may affect the legal remedies available.

If you or someone you know is facing such challenges, it is advisable to seek guidance from a qualified lawyer or legal professional. For safe and confidential support, you may also consider reaching out to trusted legal platforms such as Adlegal.