Customs Act 1962

The Customs Act 1962 is one of the most significant legislations in India’s trade and taxation framework. Enacted by the Government of India, this act provides the legal foundation for the levy of customs duty, regulation of imports and exports, and prevention of unlawful trade practices such as smuggling. Over the decades, the Act has evolved into a comprehensive code governing customs regulations, ensuring both compliance and smooth facilitation of international trade.

The primary objective of the Customs Act 1962 was to bring uniformity in the levy and collection of custom duties across the country. It ensures that all goods entering or leaving India are properly assessed, valued, and taxed, thereby safeguarding national revenue and protecting domestic industries from unfair foreign competition. The importance of custom duty goes beyond revenue collection — it also acts as a tool to regulate the flow of goods, encourage indigenous production, and maintain economic stability.

For businesses engaged in cross-border trade, adherence to customs regulations is not optional but mandatory. Importers and exporters need to comply with the provisions of the act to avoid penalties, confiscation of goods, or even criminal proceedings in cases of misdeclaration or evasion of customs duty. Similarly, for NRIs who frequently bring goods into India or ship items overseas, understanding the customs act 1962 becomes essential to prevent disputes or excessive charges at ports of entry.

In today’s globalized economy, where trade volumes are constantly rising, the Customs Act continues to play a pivotal role in balancing trade facilitation with legal enforcement. For entrepreneurs, corporates, and individuals, a clear understanding of the importance of custom duty is crucial to ensure compliance, cost efficiency, and uninterrupted business operations.

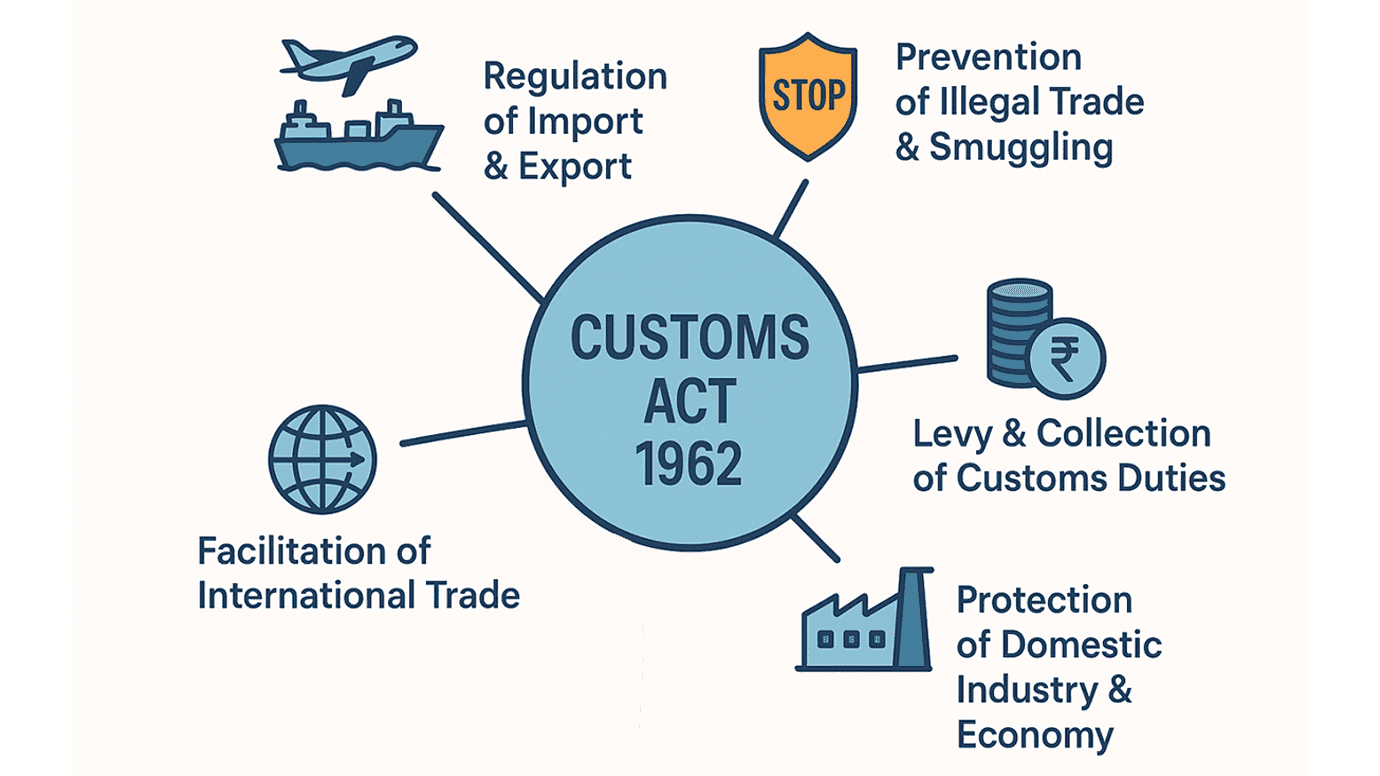

Objectives of the Customs Act 1962

The Customs Act 1962 was enacted with a clear set of objectives to strengthen India’s trade governance and safeguard national interests. This act lays down the legal framework for monitoring cross-border transactions while ensuring the seamless movement of goods. Its objectives cover a broad spectrum of areas ranging from the levy of customs duty to the protection of domestic industries and the promotion of international trade.

Regulation of Import and Export of Goods:

One of the primary goals of the customs act is the strict enforcement of import export regulations. By controlling what goods can be imported or exported, the government ensures that only permissible commodities enter or leave the country. This objective prevents the circulation of hazardous, restricted, or prohibited items and creates a balance between global trade opportunities and domestic priorities.

Prevention of Illegal Trade & Smuggling:

The Act plays a vital role in curbing illegal trade practices. Through robust customs regulations, authorities are empowered to detect, seize, and penalize activities related to smuggling, undervaluation, or false declarations. Preventing such offenses not only protects revenue but also strengthens national security.

Levy and Collection of Customs Duties:

A core function of the customs act is the levy and collection of customs duty on goods imported into or exported from India. The importance of custom duty lies in the fact that it generates substantial revenue for the government, which can be used for national development projects. Moreover, properly assessed duties discourage unfair competition from foreign goods and promote local manufacturing.

Protection of Domestic Industry & Economy:

By applying appropriate customs duty rates, the government protects Indian industries from being overwhelmed by cheaper international products. This is especially important in sectors such as agriculture, textiles, and small-scale industries. The importance of custom duty extends to maintaining economic stability and providing a level playing field for local businesses against global competitors.

Facilitation of International Trade:

While the Act enforces strict rules, it also emphasizes the smooth facilitation of legitimate trade. By modernizing customs regulations, adopting digital clearance systems, and simplifying procedures, the act seeks to reduce red tape. This makes India a more attractive destination for global trade partnerships and investment.

In essence, the Customs Act is not merely a taxation law but a comprehensive framework that balances control with facilitation. It secures revenue through duties, shields the domestic economy, and ensures compliance with import export regulations, while also enabling businesses and NRIs to engage confidently in global trade.

Key Definitions under the Customs Act 1962

To understand the functioning of the Customs Act, it is essential to familiarize yourself with certain key terms that form the foundation of India’s customs regulations. These definitions not only clarify the scope of the customs act but also help businesses, travelers, and NRIs ensure compliance.

Customs Duty

It refers to the tax levied on goods that are imported into or exported out of India. Under the customs act 1962, this duty serves two major purposes: generating revenue for the government and protecting domestic industries from foreign competition. The rate of customs duty depends on factors such as the type of goods, their classification under the tariff schedule, and the country of origin.

Dutiable Goods

These are items on which customs duty is chargeable under the provisions of the customs act. Not all goods attract duty; some may be exempted by government notifications. However, whenever these goods are imported or exported, they must be declared, valued, and assessed according to customs regulations. Misdeclaration of these goods can result in penalties, confiscation, or prosecution.

Import/Export

The customs act 1962 defines import as the bringing of goods into India from a place outside, and export as the taking of goods out of India to a place outside. These definitions are crucial because the levy of customs duty begins only when an import or export takes place. Businesses engaged in global trade must strictly follow the regulations laid down for imports and exports to avoid disputes and delays.

Customs Area / Customs Port

A customs area refers to the space in a port, airport, inland container depot, or land customs station where imported or export goods are kept before clearance. Similarly, a customs port is any port appointed by the government for loading or unloading goods under the customs act. Movement of goods in and out of these designated areas is strictly controlled by customs regulations to prevent unauthorized activities.

Smuggling

Smuggling is defined as the import or export of goods in violation of the provisions of the Act or without payment of the applicable customs duty. Smuggling often involves misdeclaration, concealment, or transporting goods through unauthorized routes. It is considered a serious offence, leading to confiscation of goods, monetary fines, and even imprisonment.

These definitions form the backbone of the customs act and help in interpreting how the law applies to different trade and travel situations.

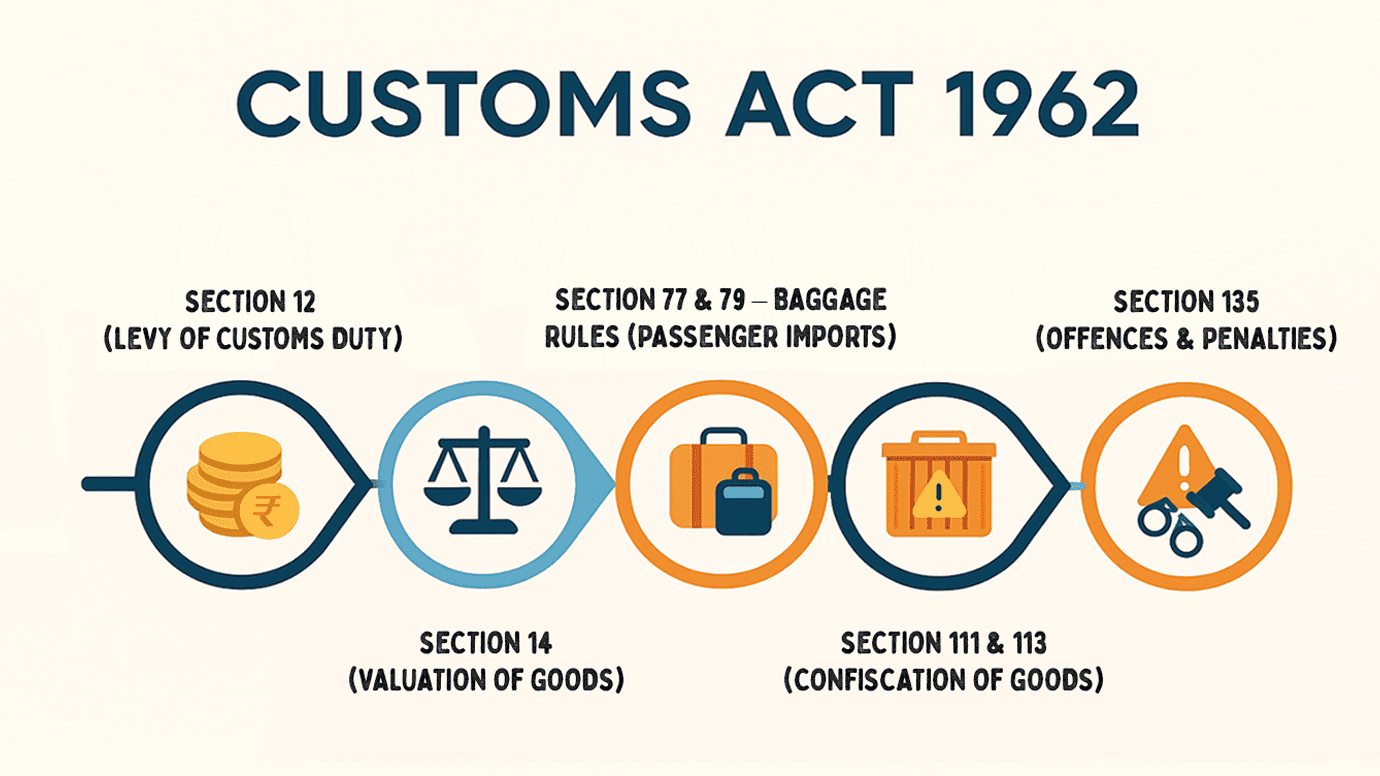

Important Provisions of the Customs Act 1962

The Customs Act 1962 is a comprehensive legislation that governs the levy of customs duty, the regulation of imports and exports, and the prevention of illegal trade. To ensure proper compliance with regulations, the Act lays down several crucial provisions. Below are some of the most important sections that every importer, exporter, and traveler should know.

- Section 12 (Levy of Customs Duty): This section forms the backbone of the customs act 1962. It authorizes the government to impose duty on all goods imported into or exported from India. The rate of duty is determined by the Customs Tariff Act, and exemptions may be granted through official notifications. Section 12 reflects the importance of duty collection in generating national revenue and protecting local industries.

- Section 14 (Valuation of Goods): Accurate valuation is critical for calculating the correct customs duty. Section 14 specifies the import and export valuation rules and guidelines. Goods must be assessed based on their “transaction value” — the actual price paid or payable for the goods, adjusted for freight, insurance, and other charges. This provision prevents undervaluation or over-invoicing and ensures fair trade practices.

- Section 77 & 79 – Baggage Rules (Passenger Imports): Sections 77 and 79 deal with baggage carried by passengers arriving in India. Under these provisions, travelers must declare dutiable items at the time of arrival. Certain personal belongings and goods within the permissible allowance are exempt from customs duty, while others are taxed according to the regulations. These rules are particularly relevant for NRIs and frequent international travelers.

- Section 111 & 113 (Confiscation of Goods): To curb violations, Sections 111 and 113 empower customs authorities to confiscate improperly imported or exported goods. Confiscation may apply in cases of misdeclaration, undervaluation, prohibited items, or attempts to evade customs duty. These provisions underline the strict enforcement powers vested in the customs act to protect national revenue and security.

- Section 135 (Offences & Penalties): Section 135 deals with the criminal aspect of violations under the custom duty act 1962. Offences such as smuggling, fraudulent evasion of duty, and false documentation attract stringent punishments, including fines, imprisonment, or both. The penalties under customs act vary depending on the gravity of the offence, making this section a strong deterrent against unlawful trade practices.

Customs Authorities & Powers

The customs act 1962 vests significant powers in customs officers for enforcement. Authorities such as the Central Board of Indirect Taxes and Customs (CBIC) and the Directorate of Revenue Intelligence (DRI) play a critical role in implementing customs regulations, conducting investigations, seizing goods, and prosecuting offenders. Their mandate ensures transparency, compliance, and protection of the national economy.

In summary, these provisions of the customs act highlight how India balances trade facilitation with strict enforcement. From the levy of duty to the imposition of penalties, each section ensures accountability in international trade and secures the country’s economic interests.

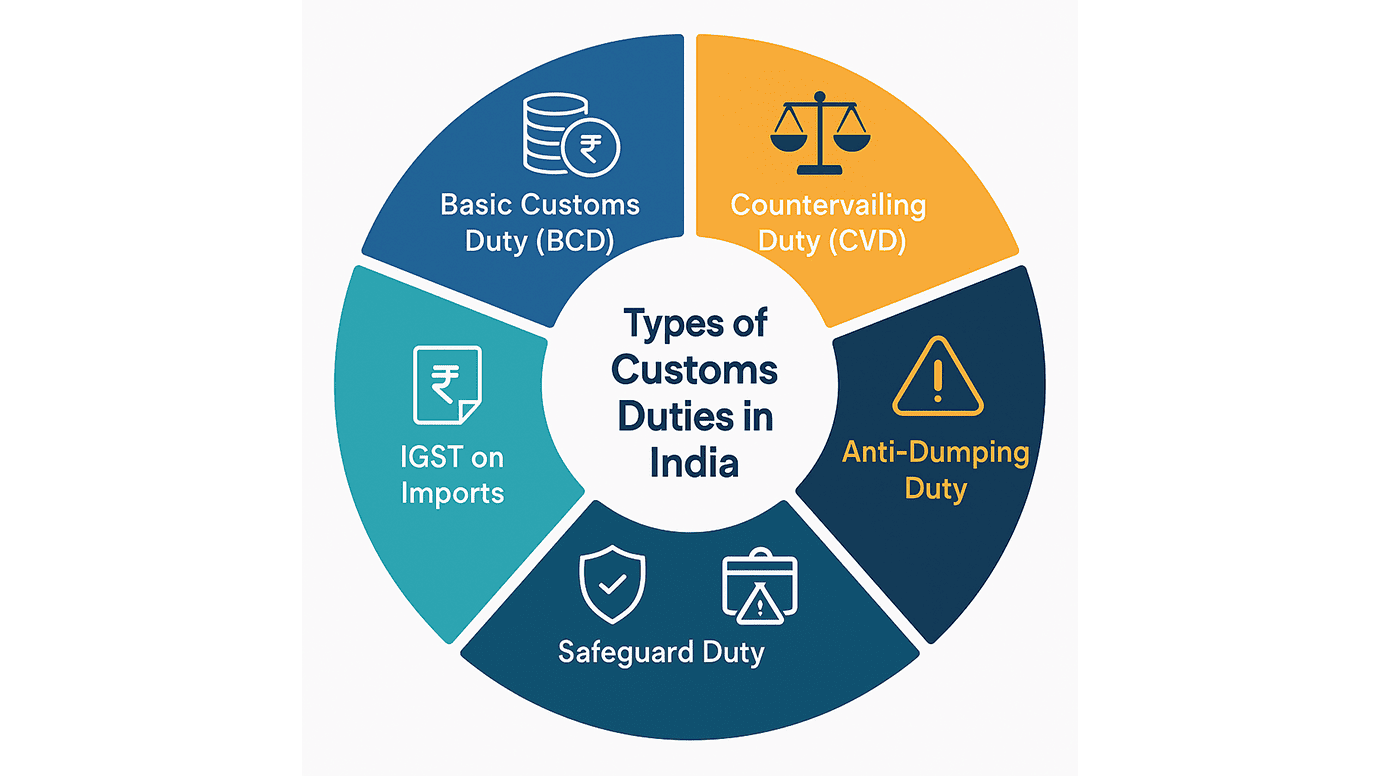

Types of Custom Duties in India

The Customs Act provides the legal framework for the levy and collection of customs duty in India. Different categories of duties are imposed depending on the nature of goods, their origin, and the purpose of import or export. Understanding these types of duties is crucial for businesses, travelers, and NRIs to remain compliant with the regulations and avoid unnecessary liabilities under the act.

Basic Customs Duty (BCD)

It is the standard tax imposed on goods imported into India. Its rate is determined by the Customs Tariff Act and varies depending on the classification of goods. The objective of this duty is both revenue collection and protection of domestic industries from excessive foreign competition. BCD is one of the oldest forms of customs duty recognized under the act.

Countervailing Duty (CVD)

The Countervailing Duty is imposed on imported goods to equalize the excise duty levied on similar goods manufactured within India. Under the customs act 1962, CVD ensures a level playing field between domestic producers and foreign suppliers. For example, if a product manufactured in India attracts excise duty, then its imported counterpart will attract an equivalent duty in the form of CVD.

Anti-Dumping Duty

Anti-dumping duties are imposed when goods are imported at prices significantly lower than their normal value in the exporting country. Such practices harm domestic industries, and therefore, the custom duty act 1962 empowers the government to impose anti-dumping duties to safeguard local businesses. This duty is a corrective measure under customs regulations to prevent unfair trade practices.

Safeguard Duty

Safeguard Duty is applied when a sudden surge in imports threatens to harm domestic industries. Unlike anti-dumping duties, which focus on unfair pricing, safeguard duty addresses the quantity and impact of imports on local markets. The customs act authorizes this duty as a temporary measure to protect vulnerable sectors until they adapt to competition.

IGST on Imports

With the introduction of GST, imports are subject to Integrated Goods and Services Tax (IGST) in addition to other duties. The levy of IGST on imports aligns with the principle of taxation under both GST and customs law, ensuring that imported goods are taxed at par with domestically produced goods. This integration of GST with the customs act streamlines the tax structure and prevents revenue leakage.

The different types of customs duty demonstrate how the law balances revenue generation, trade facilitation, and protection of domestic industries.

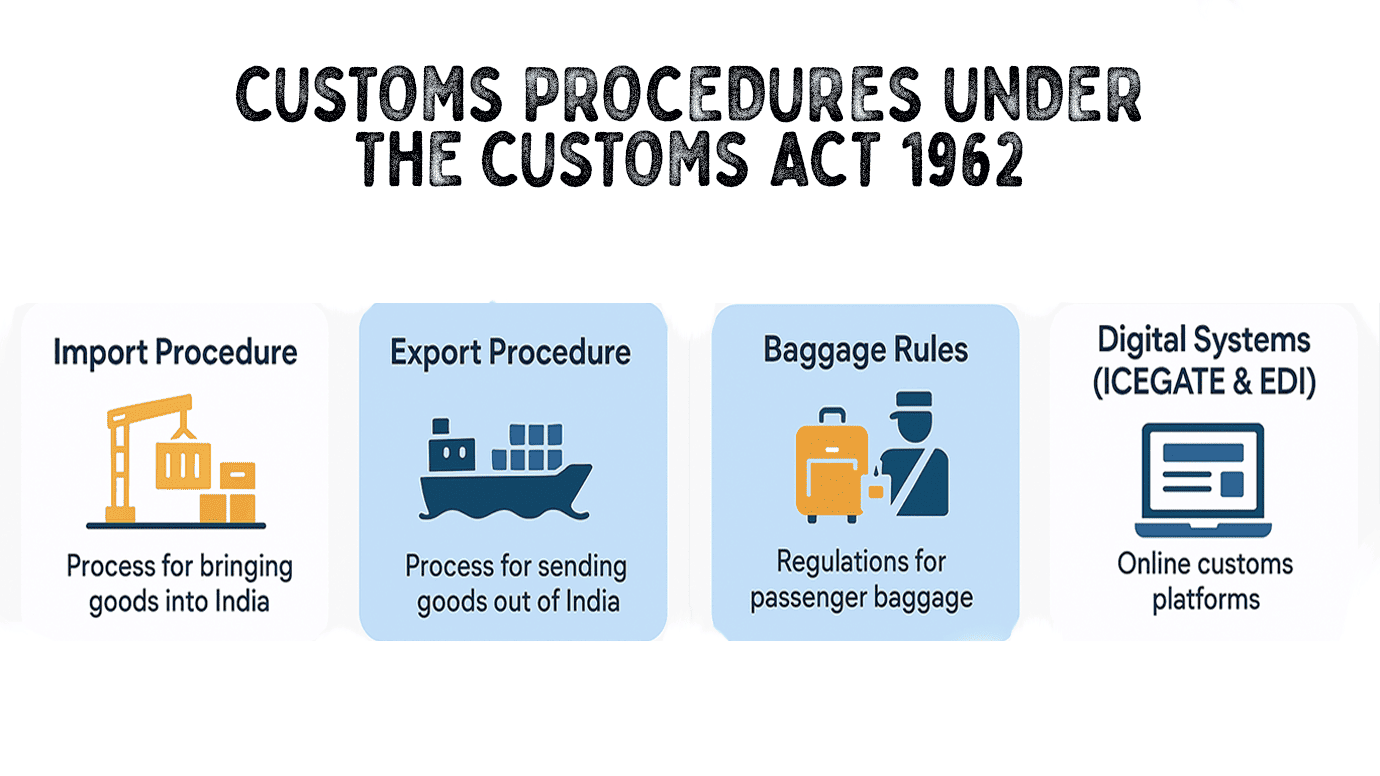

Customs Procedures under the Customs Act 1962

The customs act 1962 lays down a systematic framework for the movement of goods across international borders. Whether it involves imports, exports, or passenger baggage, every transaction must comply with established regulations. A proper understanding of the clearance process ensures smooth trade, timely delivery, and avoidance of penalties.

Import Procedure

It begins when goods arrive at a port, airport, or land customs station in India. Importers must file a Bill of Entry, which declares the nature, quantity, and value of the goods. Customs authorities then conduct an assessment based on customs duty rates, classification under tariff schedules, and export valuation rules (applied in reverse for imports). After assessment, goods undergo inspection, and only upon payment of applicable customs duty, clearance is granted. This structured process, defined under the custom duty act 1962, prevents undervaluation, misdeclaration, and illegal entry of restricted goods.

Export Procedure

It is equally important under the customs act. Exporters must file a Shipping Bill containing complete details of the goods to be shipped abroad. Customs officers may examine the goods to verify compliance with restrictions and trade agreements. Once verified, the authorities issue a Let Export Order (LEO), allowing the consignment to leave the country. The export procedure ensures that no prohibited items are sent out of India and that exporters remain compliant with customs regulations while benefiting from export incentives or rebates.

Baggage Rules for Travelers

Under Sections 77 and 79 of the customs act 1962, passengers entering India must declare dutiable goods carried in their baggage. Items within the prescribed allowance are exempt, but goods beyond the limit attract customs duty. The baggage rules help streamline clearance for international travelers while ensuring that valuable or restricted goods are not smuggled under the guise of personal belongings.

Role of Digital Systems (ICEGATE & EDI)

Modernization of the customs clearance process has been a major focus of the custom duty act 1962. Platforms like ICEGATE (Indian Customs Electronic Gateway) and the Electronic Data Interchange (EDI) system have digitized filing, assessment, and tracking of import and export documents. These systems not only reduce paperwork and delays but also bring greater transparency to the import and export procedure. Digitalization ensures faster compliance with customs regulations, making India’s trade ecosystem more efficient and globally competitive.

The customs act provides a robust legal framework for both importers and exporters. By following the prescribed import procedure and export procedure, businesses can ensure compliance with customs regulations, avoid disputes, and maintain smooth operations. For travelers, adherence to baggage rules and payment of customs duty when required helps prevent penalties. With digital platforms like ICEGATE, the customs clearance process is becoming simpler, faster, and more transparent — reflecting the modernization of India’s trade practices under the custom duty act 1962.

Penalties and Offences under the Customs Act 1962

The customs act 1962 not only governs the levy of customs duty and the customs clearance of goods but also prescribes strict penalties for violations. This act empowers customs authorities to take legal action against individuals and businesses that engage in smuggling, misdeclaration, undervaluation, or deliberate evasion of duty. These provisions highlight the seriousness of compliance in the documentation in export import procedure and the broader trade ecosystem.

- Smuggling Offences: Smuggling is one of the most serious offences under the customs act. It involves the illegal import or export of goods without paying the applicable duty or by bypassing the legal customs clearance Offenders often conceal goods, misdeclare them, or use unauthorized routes. The penalties for smuggling include confiscation of goods, heavy fines, and imprisonment, depending on the value and nature of the offence.

- Undervaluation and Misdeclaration: Another common offence under the custom duty act 1962 is undervaluation or misdeclaration of goods in import/export documents. Importers or exporters may understate the value of goods to reduce customs duty or misclassify them to bypass restrictions. Since accurate documentation is critical, such acts are treated as deliberate fraud. Penalties include reassessment of duty, fines, confiscation, and in severe cases, prosecution.

- Non-Payment or Evasion of Duty: Evasion of customs duty is a direct violation of the customs act 1962. This may occur through deliberate non-payment, manipulation of invoices, or using fraudulent exemptions. The customs act allows authorities to recover the unpaid duty, impose interest, and levy additional penalties. Persistent offenders may face criminal charges under the penalties under customs act, making compliance in the clearance process vital for all stakeholders.

- Arrests and Prosecution: The custom duty act 1962 empowers customs authorities to arrest individuals involved in serious violations such as smuggling or large-scale duty evasion. Offenders may be prosecuted in court, leading to imprisonment for up to seven years, depending on the gravity of the case. These stringent provisions serve as a deterrent and highlight the government’s commitment to enforcing trade discipline through the customs act.

The customs act 1962 makes it clear that offences like smuggling, misdeclaration, and evasion of customs duty are not minor violations but criminal acts with severe consequences. Businesses engaged in international trade must ensure accuracy in the documentation, follow the prescribed customs clearance norms, and comply with the regulations. Failure to do so can result in heavy penalties, prosecution, and long-term reputational damage.

Recent Amendments & Updates under the Customs Act 1962

The customs act 1962 is a dynamic legislation that adapts to the evolving needs of international trade, revenue collection, and national security. Over the years, several amendments have been introduced to simplify the customs clearance process, align with global practices, and strengthen compliance under import export regulations. Below are some of the recent highlights that reflect the government’s proactive approach in modernizing the act.

Latest Changes in Customs Duty Rates (Union Budget)

Every year, the Union Budget introduces revisions in customs duty rates to meet fiscal goals and support domestic industries. Recent budgets have rationalized duties on raw materials to encourage manufacturing under the “Make in India” initiative, while raising duties on finished products to protect local businesses. Such adjustments under the customs act demonstrate the dual objective of revenue generation and economic development. For importers and exporters, staying updated on these duty changes is critical to avoid miscalculations that could lead to penalties under customs act.

Digital Initiatives by CBIC

The Central Board of Indirect Taxes and Customs (CBIC) has taken major steps to digitize the customs clearance process. Platforms such as ICEGATE (Indian Customs Electronic Gateway) and the EDI (Electronic Data Interchange) system have been upgraded to enable faster filing of documents, real-time tracking of consignments, and online payment of customs duty. These digital initiatives ensure transparency, reduce human intervention, and simplify compliance with customs regulations. They also minimize errors in documentation for import export regulations, which is often a cause of delays or disputes.

Focus on Ease of Doing Business & Reducing Red Tape

One of the key reforms under the custom duty act 1962 has been the push for “ease of doing business.” India has introduced measures such as faceless assessments, risk management systems, and paperless documentation to make the customs clearance process quicker and more efficient. These reforms reduce red tape and ensure smoother compliance with restrictions on import and export under customs act. By streamlining procedures, businesses save time and resources while maintaining adherence to customs regulations.

The continuous updates to the customs act 1962 highlight the government’s commitment to balancing trade facilitation with regulatory control. From rationalized customs duty rates to advanced digital platforms and business-friendly reforms, the law is evolving in line with global standards. For businesses engaged in international trade, understanding these amendments is essential to comply with import export regulations, avoid penalties, and benefit from smoother trade operations under India’s modernized customs framework.

Practical Importance for Businesses & NRIs

The customs act 1962 is not just a legal framework; it directly impacts businesses, entrepreneurs, and NRIs engaged in international trade or travel. Whether it is compliance with customs regulations, smooth clearance, or avoiding legal disputes, the custom duty act 1962 plays a vital role in day-to-day trade activities and passenger baggage rules. Understanding its practical importance ensures seamless cross-border transactions while reducing the risk of penalties under customs act.

Compliance for Import/Export Businesses

For businesses involved in global trade, strict adherence to the customs act and regulations is critical. The customs clearance process requires accurate documentation, correct declaration of goods, and timely payment of customs duty. Failure to comply can result in delays, confiscation of goods, or monetary penalties. Proper compliance not only ensures uninterrupted operations but also enhances a company’s credibility in international markets.

Customs Clearance for NRIs Sending Goods to India

NRIs frequently send personal items, gifts, or commercial shipments to India. Under the custom duty act 1962, these goods must undergo the prescribed clearance procedures. NRIs need to declare goods honestly and pay applicable duty to avoid disputes. Any misdeclaration or undervaluation during the clearance process can attract heavy penalties under customs act, leading to delays and added costs. By understanding the rules, NRIs can avoid unpleasant surprises at ports of entry.

How Violations Can Lead to Fines or Imprisonment

Violations of the customs act 1962, such as smuggling, non-payment of customs duty, or false documentation, are treated as serious offences. The law empowers authorities to impose strict penalties under customs act, which may include hefty fines, confiscation of goods, and even imprisonment in severe cases. For businesses, such violations can result in reputational damage and loss of clients, while for individuals, they can cause long-term legal complications. Compliance with the act is therefore not just advisable but essential.

The practical relevance of the customs act 1962 lies in its role as both a facilitator and regulator of trade. For businesses, it ensures smooth international operations through a clear customs clearance process. For NRIs, it provides guidelines for sending goods to India without legal hassles. And for everyone, it serves as a reminder that violations can lead to serious penalties under customs act. Ultimately, the act safeguards revenue, promotes transparency, and ensures fairness in global trade.

Role of Legal Experts in Customs Matters

The provisions of the customs act 1962 are complex and require in-depth understanding to ensure compliance. From the payment of customs duty to navigating the clearance process, businesses and individuals often face challenges that can lead to disputes or legal consequences. This is where experienced legal experts play a crucial role in providing guidance, representation, and protection against costly mistakes under the customs act.

Legal Representation in Customs Disputes

Disputes may arise over the classification of goods, valuation, exemption claims, or allegations of smuggling and duty evasion. Legal experts provide professional representation in such cases before adjudicating authorities and appellate forums. They ensure that clients’ rights under the customs act 1962 are protected, all evidence is properly presented, and the case is argued effectively to secure a fair outcome.

Advisory for Businesses on Compliance

Businesses engaged in international trade must adhere strictly to the customs act and related regulations. Legal professionals assist companies in understanding duty structures, exemptions, licensing requirements, and proper documentation. By offering tailored advisory services, they help organizations streamline the customs clearance process and avoid errors that could trigger investigations or disputes.

Assistance in Appeals before Customs Appellate Tribunal / High Court

When decisions by customs authorities are contested, appeals can be filed before the Customs, Excise and Service Tax Appellate Tribunal (CESTAT) or even the High Court. Legal experts specializing in the customs act 1962 play a key role in drafting appeals, preparing arguments, and presenting cases in higher forums. Their knowledge of statutes, case law, and procedural rules significantly improves the chances of a favorable judgment.

Preventing Penalties & Avoiding Litigation

One of the most valuable contributions of legal experts is helping clients avoid violations of the customs act in the first place. By ensuring proper compliance with customs duty obligations and guiding businesses through the customs clearance process, lawyers prevent exposure to fines, confiscation of goods, or prosecution. Proactive legal assistance reduces risks, saves costs, and helps maintain the reputation of businesses engaged in global trade.

Legal experts act as vital partners for businesses, NRIs, and individuals navigating the complexities of the customs act 1962. Whether it is securing smooth clearance process, handling disputes, or representing clients in appellate forums, their role ensures compliance, minimizes liability, and safeguards trade interests. With professional legal support, clients can focus on growth while staying protected under the provisions of the customs act. For more information, you can also go through our dedicated page on Customs Lawyer.

FAQs

A. The customs act 1962 is the primary legislation governing the levy of customs duty, regulation of imports and exports, and prevention of smuggling. It ensures compliance with import export regulations while protecting national revenue and supporting domestic industries.

A. The customs act aims to regulate imports and exports, impose customs duty on dutiable goods, prevent illegal trade, and simplify the clearance process. It also provides a framework for restrictions on import and export under customs act to safeguard the economy.

A. The main types of custom duty include Basic Customs Duty, Countervailing Duty, Anti-Dumping Duty, Safeguard Duty, and IGST on imports. These duties balance trade facilitation with protection of domestic industries.

A. It involves filing a Bill of Entry, valuation of goods, payment of customs duty, and inspection by customs authorities. Once the customs clearance is complete, the goods are released into the domestic market in accordance with regulations.

A.It requires filing a Shipping Bill, verification of goods, and issuance of a Let Export Order. Compliance with export procedure rules under the customs act ensures that shipments are cleared smoothly and in line with regulations.

A.Accurate documentation is vital to ensure compliance with the customs act 1962. Incomplete or incorrect paperwork can delay the customs clearance process and may even result in penalties.

Conclusion

The customs act 1962 remains one of the most important legislations governing India’s international trade framework. By regulating the levy and collection of customs duty, ensuring proper clearance, and laying down clear import export regulations, the Act protects national revenue while facilitating legitimate global commerce. The custom duty act 1962 not only provides a foundation for taxation but also creates safeguards against smuggling, undervaluation, and other illegal practices that threaten the economy.

Proper compliance with the customs act is essential for businesses, NRIs, and individuals involved in cross-border transactions. From following the prescribed import and export procedure to maintaining accurate documentation, every step of the clearance process must be carried out with precision. Adherence to export valuation rules and other regulations not only ensures smooth operations but also minimizes risks of disputes and delays.

Violations, on the other hand, can result in severe consequences. The penalties under customs act include fines, confiscation of goods, and even imprisonment in serious cases. For this reason, compliance with the customs act 1962 is not just about fulfilling legal obligations but also about protecting one’s business reputation, financial interests, and long-term trade relationships.

In an era where globalization drives opportunities, the customs act continues to serve as both a regulator and facilitator. By understanding its provisions and aligning with the requirements of the customs duty structure, import and export procedure, businesses and NRIs can ensure seamless international trade while avoiding unnecessary legal hurdles. Ultimately, strict compliance with the custom duty act 1962 and the prescribed customs clearance process is the key to building trust, achieving efficiency, and securing growth in global markets. For more information on other cases, go to our Homepage.

Disclaimer:

This blog is intended solely for educational and informational purposes. It provides a general overview of the Customs Act 1962, including aspects of customs duty, customs clearance, import and export procedure, and related customs regulations. The content should not be construed as legal advice or relied upon for decision-making in specific cases.

Matters relating to the custom duty act 1962, documentation in export import procedure, or penalties under customs act often depend on individual facts, circumstances, and evolving legal interpretations. If you are facing issues related to customs clearance process, restrictions on import and export under customs act, or disputes with authorities, it is strongly recommended to consult a qualified lawyer or legal professional for personalized guidance.